A solid budget is the bedrock of any successful startup. It’s your financial roadmap, helping you allocate resources wisely, track your progress, and make informed decisions. However, budget building for startups requires a distinct approach compared to traditional businesses.

Here’s a crash course in startup budgeting and how iCre8Solutions can guide you through the process.

Startup Budgeting: Key Considerations

- Embrace Projections: Unlike established businesses, your budget will rely heavily on estimates and projections for revenue and expenses. Do thorough research on your industry, target market, and competitor pricing to forecast as accurately as possible.

- Factor in Burn Rate: Burn rate is how quickly your startup spends cash. Track it closely as it determines how much runway you have before needing additional funding.

- Prioritize Flexibility: Startups must be agile. Build flexibility into your budget to account for pivots, unexpected costs, and the dynamic nature of early-stage businesses.

- Set Milestones: Link your budget to specific milestones and goals. This helps measure progress and identify potential budget shortfalls early on.

Budget Building for Startups: Step-by-Step

- Estimate Revenue: Consider multiple revenue models (subscriptions, sales, etc.). Research industry benchmarks, but be realistic in your early projections.

- List Fixed Costs: Rent, salaries, software subscriptions, and essential services fall into this category.

- List Variable Costs: These costs fluctuate with sales volume, such as materials, marketing expenses, and shipping.

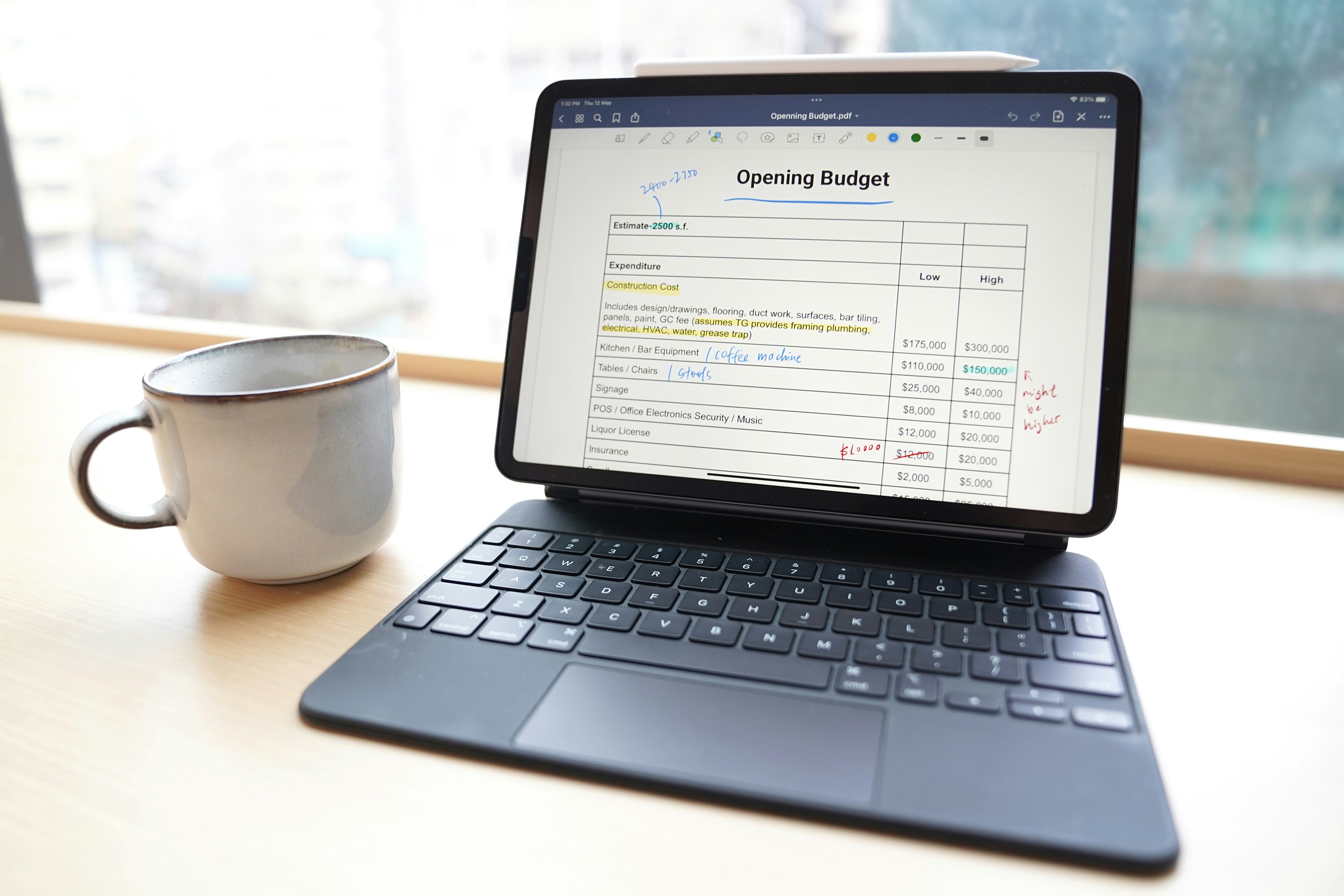

- Include One-Time Costs: Legal fees, website development, equipment purchases – don’t forget these significant upfront expenses.

- Build in a Buffer: Unexpected costs are inevitable. A small contingency reserve provides a safety net.

How iCre8Solutions

Building a startup budget is a complex undertaking, especially for first-time entrepreneurs. Here’s how iCre8Solutions can provide expert support:

- Tailored Financial Modeling: Our experienced team creates custom budget models that align with your business goals and specific industry challenges.

- Insightful Forecasting: We leverage data analytics and market research to help you make accurate revenue and expense projections.

- Cash Flow Management: We’ll help you develop strategies to optimize your cash flow and manage your burn rate effectively.

- Ongoing Monitoring and Adjustment: Budgets should be living documents. We’ll work with you to regularly review your budget versus actual results, identifying potential trouble spots and making necessary adjustments.

Budgeting for Success: Additional Tips

- Choose the Right Tools: From spreadsheets to dedicated budgeting software, select the tools that best suit your startup’s size and needs.

- Get Buy-In From Your Team: Involve your team in the budget-building process to foster a sense of ownership and financial accountability.

- Seek Expert Advice: Don’t hesitate to consult with financial professionals, like those at iCre8 Solutions, for guidance and support, especially if you’re new to budgeting or tackling complex financial planning.

Budget Building for Startups: The Bottom Line

A well-crafted budget gives your startup direction, stability, and a competitive edge. It empowers you to make strategic decisions, attract investors, and chart a course for long-term success.

Let iCre8Solutions guide you through budget building for startups. Contact us today to schedule a consultation and get started on your path to financial clarity!